According to the Federal Cartel Office, the German Zappos clone Zalando was recently about to receive some fresh capital from Emesco AB, a subsidiary of Kinnevik AB, but an update by the Federal Cartel Office has now revealed that this new capital injection has not taken place.

Why is this? We don’t know the reasons yet, but Zalando still seems to be in good shape. Holtzbrinck Ventures, a German venture capital firm that owns about 16% of Zalando, recently stated in an article by Manager Magazin that it values its shares three times as high as the price that the social network StudiVZ was sold for at €85 million. If we calculate, 3 x €85 million, this makes €255 million. If Holzbrinck Ventures values its 16% of Zalando at €255 million, this means that they value the whole company at about €1.6 billion. Wow!

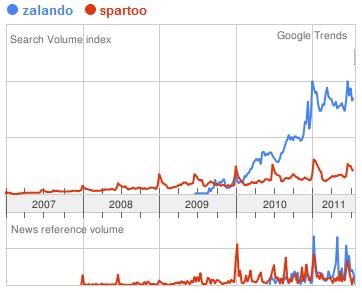

But the competition never sleeps – according to the news agency Reuters, Zalando’s French competitor Spartoo has just hired the investment bank Jefferies to help it raise €100 million from a new investor as it seeks to expand. The Echirolles-based company, which calls itself Europe’s ‘No. 1’ online shoe retailer, has said it’s aiming to boost sales to €100 million this year, from €60 million last year. Curiously, an unnamed source at Reuters stated that Spartoo was now worth between €200 million and €250 million. If you compare the search volume and news reference volume of the two brands (Zalando and Spartoo) on Google Trends, it seems that Zalando is leading the race. One reason for this development might be the fact that Zalando has invested heavily into funny TV commercials – so watch this space!

If you compare the search volume and news reference volume of the two brands (Zalando and Spartoo) on Google Trends, it seems that Zalando is leading the race. One reason for this development might be the fact that Zalando has invested heavily into funny TV commercials – so watch this space!

By the way: If you’d like to stay up-to-date with startup news and interesting opportunities, make sure to subscribe to our free weekly EU-Startups Newsletter.

Cash is key in this competitive environment. Zalando heavily increased the bidding level on search engines adwords and affiliated programs partners that makes competition fierce in the run for clients acquisition. According to estimations, where Zalando operates, it went from an average of 35€ to 70€…

The only place where Spartoo might be ahead, is their presence on different horizontal integration, counting various activities (stylistclick, shoes.fr, le-temple.com) and strategical positions on every segment of the shoe e-tailing business, especially the premium and luxury activities becoming more and more crowded.

I love your website!! Great, great posts! Thanks for making time to do this