Food delivery startups have gone from hot to sizzling since the coronavirus pandemic started. Already popular across hundreds of cities in Europe, self isolation restrictions brought the convenient idea of ‘restaurant quality’ food at home to the forefront of more people’s minds. After a momentary dip in confidence due to sanitation worries, these comet-like companies quickly corrected their course and are continuing along the path of stellar fast-growth.

If we look at the top players on the leader board that were founded in the last 10 years in Europe, then Glovo, Deliveroo and Delivery Hero are right up there. With millions of users, 30K+ employees, combined funding rounds worth billions, and all three having hit unicorn status, there’s no stopping them.

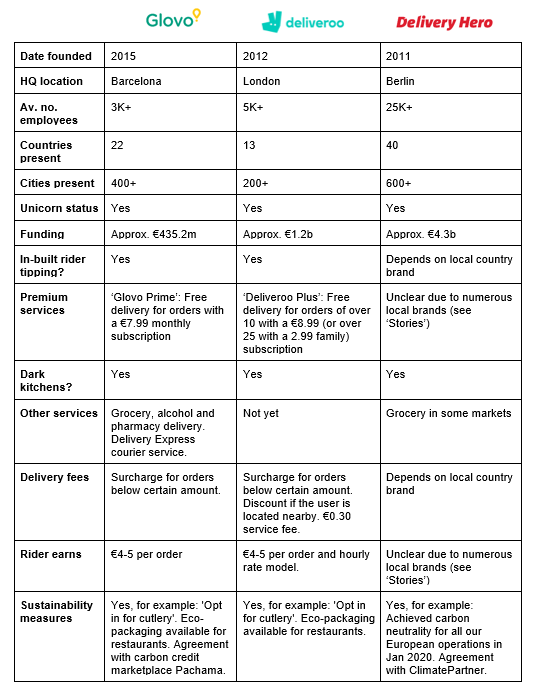

But how exactly do they shape up when compared right next to each other? How many countries and cities are they available in? What services do they offer and what fees are involved? To get a handle on the comparison, we’ve made a short table to see them side-by-side.

Stories

Delivery Hero was founded in 2011 in Berlin by Niklas Östberg. He has since grown the company into a massive 25K+ person team of 100 nationalities over 5 continents, with around 1.5K employees in their Berlin HQ alone. They are currently the largest global food network (outside of China), operating in 40+ markets and over 600+ cities.When it comes to funding, the German company has closed a total of 16 rounds, totalling around €4.3 billion. In addition, they’ve acquired more than a few food delivery startups across Europe, such as Foody in Cyprus, to expand their reach internationally. When we interviewed founder Niklas about what sets them apart, he mentioned their local approach; operating via a number of local brands around the world they’re able to adjust to each local market. Today, it was announced that Delivery Hero will likely be accepted into the DAX, a stock index of Germany’s most valuable publicly traded companies.

Deliveroo was founded the following year, in 2012. This London-based team has since grown to a team of 5K+, operating in 13 countries and over +200 cities. The team has closed 9 funding rounds, with the last being a Series G round in May 2019, from Amazon, which it funnelled into more personalised for its users and creating more flexible, well-paid work for riders. The total raised by the startup is now approximately €1.2 billion, with it being no secret that this company has also achieved unicorn status. Regarding acquisitions, the company has made the news in recent years, for example by acquiring Scottish software company Cultivate to improve payment processes. In particular, it’s also worth mentioning that Deliveroo offers discounts for users if they order from restaurants closer to home, as well as using machine learning algorithms to optimize routes, overall allowing riders to complete more deliveries per hour and increase earnings.

Glovo is the baby of the trio, founded in 2015 in Barcelona. Despite having the smallest of all teams with +3K employees, the team has still managed to expand to 22 countries and 400+, more than its older counterpart Deliveroo. The startup has closed 9 rounds, securing in total approximately €435.2 million, the smallest amount of all three companies. Their latest funding was indeed raised in December 2019 as a Series E round, securing their spot as the second unicorn in Spain. They similarly strategise their global expansion through a number of acquisitions, such as when they recently entered the Polish market by acquiring Pizza Portal. Unique aspects to mention about Glovo is their diversification from just food delivery to also grocery, alcohol and pharmacy delivery – with the latter proving exceptionally popular throughout the pandemic.

Competitors

Giants like US-based Uber Eats (2014, San Francisco), and Europe-based pioneers Just Eat (London, 2001), and Takeaway.com (Amsterdam, 2000) were on the scene 5-10 years before these three came around. In addition, in the past few years there has been a whole host of newbies on the block, including weekly meal package startups and delivery-first dark kitchens. We recently created a list of 10 food delivery startups smashing it in 2020, if you’d like to know more. In addition, ride-sharing startup Bolt recently joined the food delivery scene. In 2019, they launched their app ‘Bolt Food’, which is now present in 12 countries.

What’s next?

Finally, we can’t talk about food delivery startups without touching on the news surrounding rider working conditions. Questions have arisen over the ethical nature of labour conditions after strikes and court cases have repeatedly hit the news. Freelancer contracts that offer riders no holiday or sick pay, technical difficulties or mishaps resulting in just a few euros after hours of work, and public-facing roles in coronavirus times are just a few of the issues raised. As these startups continue to grow at a fast pace, they will certainly need to resolve these issues as European and national regulations start to catch up with them.

Secondly, even though restaurant food delivery is certainly a huge trend, the coronavirus pandemic may have just set off a parallel movement that could be serious competition: zero waste grocery boxes for cooking at home. As we discussed recently with the co-founders of The Mindful Chef, with people now more than ever focused on health, wellbeing, and their environmental impact, ordering a restaurant food at home might not continue to be the smart choice. In this case, it could be down to these leading startups to employ measures like more dark kitchens to guarantee even faster delivery for the services they already provide. In addition, they could diversify into these new sectors, for example with grocery drop-off or courier services, something the Glovo has already launched with (so far) huge success.